Non Banking Financial Companies, How are they Different from Banks?

What is the News?

- In a move to make more liquidity available to non banking finance firms, the Reserve Bank of India has relaxed the securitisation norms by relaxing the minimum holding period requirement. The move follows a demand from the government for a special window for NBFCs, to provide them liquidity support.

- RBI has decided to relax the Minimum Holding Period (MHP) requirement for originating NBFCs, as they are now allowed to securitise loans with maturity of more than five years after holding them for six months on their books, as compared to one year earlier.

What are NBFCs?

Non Banking Financial Companies are those companies which provide banking services without meeting the legal definition of a bank.

Non Banking Financial Companies are those companies which provide banking services without meeting the legal definition of a bank.- NBFC is incorporated under the Companies Act, 1956.

- NBFCs are engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, insurance business etc.,.

- Companies cannot be NBFCs if their primary business is related to agriculture activity, industrial activity, sale/purchase/construction of immovable property.

- Non-Banking Financial Companies are regulated by different regulators in India such as RBI, SEBI, National Housing Bank and Department of Company.

- The 50-50 test is used as an anchor to register an NBFC with RBI.

What is 50-50 test?

- 50-50 Test is defined as the test for companies having at least 50% assets as financial assets and its income from financial assets is more than 50% of the gross income.

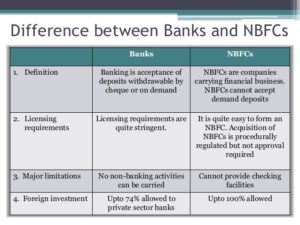

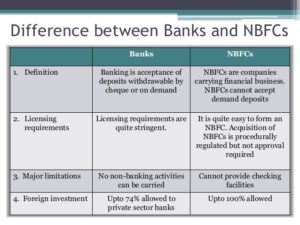

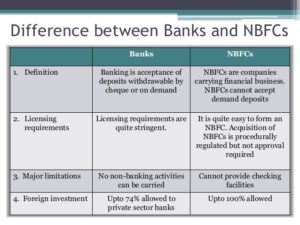

How are NBFCs different from Banks?

- NBFCs lend and make investments, and hence their activities are akin to that of banks.

- NBFCs cannot accept demand deposits (they can accept term deposits).

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself.

- Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.

- The norm of Public Sector Lending and Cash Reserve Requirement does not apply to NBFCs.

Non Banking Financial Companies are those companies which provide banking services without meeting the legal definition of a bank.

Non Banking Financial Companies are those companies which provide banking services without meeting the legal definition of a bank.