Fugitive Economic Offender Ordinance

HOT ISSUES FOR MAINS(TOPIC #10)(SecureIas Initiative)

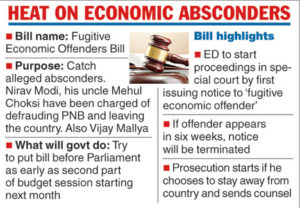

Fugitive economic offenders ordinance

A fugitive economic offender is any individual against whom a warrant for arrest in relation to a scheduled offence has been issued by any court in India and who has either left India to avoid criminal prosecution, or who, being abroad, refuses to return to India to face criminal prosecution

A fugitive economic offender is any individual against whom a warrant for arrest in relation to a scheduled offence has been issued by any court in India and who has either left India to avoid criminal prosecution, or who, being abroad, refuses to return to India to face criminal prosecution- The list of offences that can qualify an individual to be designated an economic offender, enumerated includes offences under several Acts such as the Negotiable Instruments Act, 1881; the Reserve Bank of India Act, 1934; the Central Excise Act, 1944; the Customs Act, 1962; the Prohibition of Benami Property Transactions Act, 1988; the Prevention of Money Laundering Act, 2002; and the Indian Penal Code

If the special court is satisfied that an individual is a fugitive economic offender, it can direct the Central government to confiscate the proceeds of the crime in India or abroad.

If the special court is satisfied that an individual is a fugitive economic offender, it can direct the Central government to confiscate the proceeds of the crime in India or abroad.- The fugitive economic offender will also be disqualified from accessing the Indian judicial system for any civil cases. I

- n keeping with the principle of ‘innocent until proven guilty’, the burden of proof for establishing that an individual is a fugitive economic offender or that certain property is part of the proceeds of a crime is on the Director appointed to file an application seeking fugitive economic offender status.

By: Sugam Bansal

A fugitive economic offender is any individual against whom a warrant for arrest in relation to a scheduled offence has been issued by any court in India and who has either left India to avoid criminal prosecution, or who, being abroad, refuses to return to India to face criminal prosecution

A fugitive economic offender is any individual against whom a warrant for arrest in relation to a scheduled offence has been issued by any court in India and who has either left India to avoid criminal prosecution, or who, being abroad, refuses to return to India to face criminal prosecution If the special court is satisfied that an individual is a fugitive economic offender, it can direct the Central government to confiscate the proceeds of the crime in India or abroad.

If the special court is satisfied that an individual is a fugitive economic offender, it can direct the Central government to confiscate the proceeds of the crime in India or abroad.